Introduction

On September 15th Ethereum – the world’s second-largest cryptocurrency by market capitalization – transitioned from Proof-of-Work (PoW) to Proof-of-Stake (PoS). While the switch has far-reaching consequences across multiple sectors, the world of Decentralized Finance (DeFi) may be among the most deeply impacted, as the PoS system introduces a new backbone for the DeFi ecosystem: a popular, crypto-native yield-bearing instrument.

In traditional finance, yield-bearing assets such as sovereign treasury bonds or mortgages have entire industry verticals and products built around them: derivatives, rehypothecation, inverse instruments, and on and on. Prior to the rise of staked ETH, the broader crypto ecosystem largely lacked such a yield-bearing instrument on which to build.

While there have been efforts to collateralize other crypto native yield-bearing instruments – such as Uniswap or other AMM liquidity provision positions – they have failed to reach broad popularity. The Ethereum AMM market on Aave, for instance, currently accounts for just $5 million in Total Value Locked, a small fraction of the platform’s TVL.

Likewise, while there are other Proof of Stake chains, they do not currently boast the influence of Ethereum. With 14.5 million ETH deposited into the staking contract, the value of staked ETH alone would be the equivalent of a top-six cryptocurrency by market capitalization in its own right. Staked ETH is thus the first yield-bearing instrument to reach significant scale in DeFi, and has the potential to both significantly grow and radically transform the ecosystem in the coming years.

While these are still the early days of staked ETH, using Nansen’s analytics platform, we can glean some insights into how traders are leveraging this new instrument via various Liquid Staked Derivatives (LSDs). For a more comprehensive explanation of staked ETH and LSDs, read our “How to Stake Ethereum” guide.

The rest of this article will analyze the adoption and usage of various Ethereum staking platforms, shedding light on who the main users are and what they’re using the various LSDs for, perhaps granting us an early look at what a fully developed staked ETH ecosystem may resemble.

Liquid Staked Ethereum Adoption Metrics

Currently, net LSD holdings are weighted towards long-term holders (addresses which have held LSDs for more than 365 days), and more recently-launched LSD protocols are attracting fresh deposits at a greater rate than incumbents.

40.5% or 5.7M of the 14.5M ETH staked is being staked via LSD platforms such as Lido and Rocket Pool as of November 2022. That figure was 35.6% three months ago and 37.7% a month ago, indicating a significant user desire for LSDs. The pace of adoption has only gathered steam after The Merge, with the percentage increase in the past month exceeding that of August and September combined. Although the majority of LSD tokens have yet to be utilized in DeFi protocols, there is still meaningful participation by holders.

Lido’s stETH is the dominant LSD market leader, with its current supply (79% of the total market) and number of holders far exceeding its competitors. 52% of the tokens reside in Aave, Curve, and Lido’s wrapped stETH contract, which indicates that the asset is embraced by both investors and DeFi applications.

stETH saw a sizable 6.2% growth in the past month, and while percentage-wise it’s lower than major competitors (cbETH and rETH), in absolute terms Lido saw more ETH being deposited into its protocol than all of the competitors listed here combined. Additionally, stETH has seen a 127% increase in average daily trading volume since The Merge. This is largely attributed to the token having the broadest integration into DeFi protocols and 7x the number of holders of its closest competitor, rETH (Rocket Pool).

Despite being the newest entrant, cbETH – which launched at the end of August 2022 – is rapidly becoming a meaningful contender. It has surpassed all other assets except stETH in supply, which reflects the amount of ETH being staked. However, the asset is not as integrated into DeFi as the other LSDs, and its distribution is more concentrated than its competitors, with its supply-to-holder ratio sitting at 3.78x of stETH.

The token holding distribution of LSDs indicates that the greatest portion of the supply for each of the derivatives belongs to long-term holders. While the early adopters take the lead, the general growth in mindshare of crypto the past year and the narrative of The Merge brought new holders to the older protocols. Rocket Pool’s rETH and Coinbase’s cbETH top the charts in terms of growth over the past 3 months, boasting an increase of 52.5% and 43.3% respectively.

Token Holding Overlaps

Some stakers diversify their ETH across various protocols to guard against security risks of a given protocol and potential smart contract exploits.

Lido’s stETH and Rocket Pool’s rETH are the most sought alternatives by the holders of the other LSDs. This is presumably due to both tokens having the largest integrations into other DeFi protocols, creating more opportunities to maximize yield.

The table above shows the number of overlapping wallets for each two LSD assets, the % dual holdership, and the mutual wallets in total. stETH and rETH (Rocket Pool) have the largest overlapping holders with 1580 wallets holding both stETH and rETH, which means 19% of the rETH holders also hold stETH meanwhile only 2.4% of the stETH holders also diversify into rETH. When we combine two holderbases (stETH and rETH holders combined), we see that 2.2% of the total group hold both of these tokens.

Token Deep Dive

stETH

The three biggest holders of the token are Aave, the wstETH contract, and Curve.Fi. These names are followed by other DeFi projects such as Fei Protocol, Nexus Mutual, yearn.finance, and Enzyme Finance. On top of those, thanks to Wrapped stETH, Ethereum stakers can opt to follow cross-chain strategies, providing liquidity on platforms like Velodrome and Kyberswap.

As of writing, 954K stETH (~21%) of the total 4.5M stETH is deployed into DeFi Lending Pools.

Aave’s stETH lending pool takes up the large majority of lending activity for the token. With more than 946K stETH in the pool, Aave handles ~99% of the lending activities for stETH. This strategy is favored by prominent DeFi service providers, including Maple Finance, Instadapp, and Index Coop, which collectively make up 17.3% of stETH staked into Aave. This can be tracked by looking at holders of aSTETH which is the token received when users stake stETH into Aave.

The next major venue in DeFi for stETH is DEXs. 540K (~12%) of the total supply sits in AMM pools with the lion’s share in Curve where users trade in the stETH - ETH pool. Expectedly, decentralized exchanges have more liquidity than centralized exchanges as the purpose of LSDs was to introduce staked assets to DeFi, and potentially due to yield farming incentives.

Although we see a decent amount of stETH being utilized in various DeFi protocols (33%), the majority (67%) of stETH supply is not utilized in DeFi applications. However, for those that are curious about how people are maximizing their yields, Nansen Portfolio is a great tool for that.

Using Nansen Portfolio, we’re able to get overviews of the positions that any wallet is engaged in. This allows us to easily get a picture of what sophisticated stakers are currently doing with their LSDs. Here are two examples:

Wallet A is using wrapped stETH to borrow wETH on Euler Finance. The wallet also holds a 1,133 cbETH (~$1.7M).

Wallet B is borrowing a wETH, USDT, and DAI on Aave against their stETH.

cbETH

Out of the 2.1M ETH staked on via Coinbase, 877K (42%) were used to issue cbETH. Although 74% of cbETH is still held in Coinbase, that figure is steadily decreasing over time, with investors opting for self-custody of cbETH and liquidity provision in DeFi protocols such as Curve and Uniswap.

rETH

Unlike Lido’s stETH, Rocket Pool’s rETH is can be mostly found on DEXs instead of lending pools. Currently, more than 293K ETH is staked on Rocket Pool, and 153K rETH have been issued, among which 26K rETH (17%) are on DEXs.

Balancer and Aura are the main protocols that investors chose to provide rETH liquidity. Among all the yield farming strategies, liquidity provision is the most accessible and thus the dominant strategy chosen by rETH owners. These pools boost the yield generated from staking ETH with token incentives and allow users to easily opt in and out of their positions.

sETH2

StakeWise’s sETH2 is one of the smaller LSD on the list but has the highest DeFi utilization rate. Out of the total 66.8K sETH2, 29.3K sETH2 (~44%) are currently on DEXs. Uniswap V3 accounts for 92% of that figure.

Well-known MEV marketplace Rook and DeFi product builder DXDao hold sETH2 as part of their diversification strategy. Meanwhile, 1.52% of the total sETH2 supply is used on Opium Protocol for a Turbo sETH2 strategy in which the investors are able to lever up on their position through staking their sETH2.

aETH

Ankr offers two LSD products, aETHb and aETHc, that differ in their reward accruing mechanisms. Neither of these assets experienced meaningful adoption in DeFi applications and only have a limited presence in DEX pools, which has also been in a steady decline throughout last year.

Apart from DEXes like Curve, Uniswap, and Sushiswap, these two assets are mostly held idle by investors, with few exceptions like LendFlare - a lending protocol that allows users to use the asset as collateral and offers passive yield on the asset, and OnX Finance - a yield aggregating platform that offers farming rewards on aETHc. However, both these platforms are tiny, with TVL on LendFlare being less than $1M and OnX Finance currently serves less than 1% of the aETHc supply.

rETH (StaFi)

StaFi’s rETH has a supply of 16.8K with individual Smart Money addresses holding 24% and DEXes holding 13%. The presence on DEXes are concentrated on Uniswap and Curve. 2.3% of the total supply is in Liqee, a lending protocol.

Protocol Token Comparisons

The growth of LSDs has also led the governance tokens for LSD protocols – including Lido’s LDO and Rocket Pool’s RPL – to emerge as significant assets in their own right.

Just looking at the market capitalizations of the various protocols, it’s clear that Lido is by far the largest, reflecting its current dominance in the Ethereum LSD sector. It’s also the top performer from a market capitalization growth perspective, increasing by over 5x YTD. However, it’s important to note that the increase in market capitalization is predominantly due to inflation in its circulating supply due to token vesting schedule unlocks, and not the price of the token appreciating.

Beyond comparing market caps, on-chain data shows that LDO and RPL have very different ownership distributions.

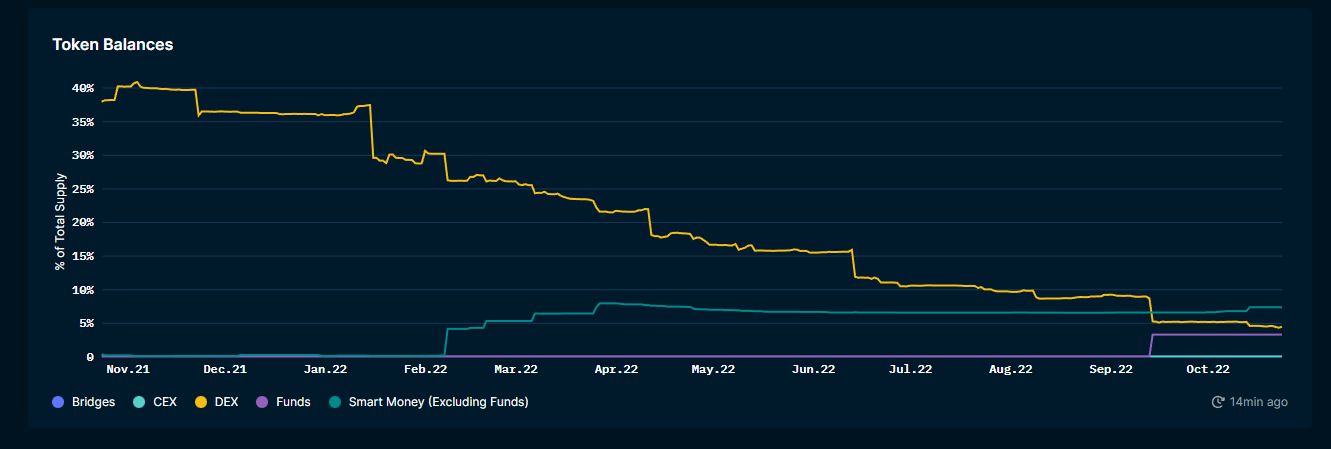

Lido (LDO) Token Distribution Table

Rocket Pool (RPL) Token Balance Table

Funds are much more likely to hold LDO compared to RPL with ~15% of LDO’s total supply being held by funds compared to RPL’s 0.64%. LDO has a strong presence on CEXes, with 5.24% of the tokens on CEXes and only 1.2% on DEXes compared to RPL’s 0.06% on CEXes and 2.77% on DEXes. This suggests that the LDO token can be readily found and traded on large centralized exchanges while you’d likely need to use a DEX to trade RPL.

Smart Money (excluding funds) formerly had a large stake in RPL tokens, owning ~21% of all RPL tokens in November 2021. However, that percentage has come down drastically to 2.85% as of 3 November 2022. Additionally, the number of wallets holding the tokens have been on an upward trend, increasing from 150 wallets for LDO and 12 wallets for RPL at the start of the year to 177 and 31, respectively. The divergence between the two tokens is apparent when analyzing Smart Money token balances. LDO sees an upward trend, holding stable at ~155M tokens while RPL has dropped massively from over 4M tokens at the peak to ~660k tokens.

Lido (LDO) Smart Money Table

Rocket Pool (RPL) Smart Money Table

Conclusion

From decentralized options such as Lido and Rocket Pool to centralized ones such as Coinbase, it’s clear that there’s a significant demand for liquid Ethereum staking solutions and that new entrants will likely continue entering the space. The amount of ETH getting staked is ever increasing and is showing no sign of slowing down since the transition to PoS.

While the majority of liquid staked ETH has yet to enter the broader DeFi space, protocols with a higher percentage deployment in DeFi appear to have a stronger moat. For instance, Lido’s widespread availability and utility in DeFi increases the amount of users interested in using Lido, which increases the number of DeFi protocols that would want to support stETH, ultimately creating a positive feedback loop. By tracking the flows of stETH on Nansen, you’re able to get a view of how the best in the space are maximizing their yields and positioning themselves in different market conditions.

Additionally, while Lido is currently the market leader and has a huge lead over its competitors, the rapid growth of Coinbase’s offering shows that the average user still trusts traditional entities and is satisfied with simply earning staked ETH yield, rather than using it as collateral or as part of a more complex yield-bearing strategy. cbETH’s low utilization rate in DeFi contracts is likely a reflection of the user base of Coinbase’s offering: less crypto native and not actively engaged in on-chain activity.

Will the perceived safety and convenience of a platform like Coinbase allow it to dethrone Lido as the most used Ethereum staking solution? Will a more complex ecosystem of products and derivatives make decentralized LSD options more popular over time? These are some of the questions that deserve ongoing monitoring as the LSD space matures and crypto begins embracing and building around the first popular source of on-chain yield.

.png)